As consumers, we live in a golden age. It has never been easier to find, purchase, watch, or listen to what we want, when we want it. These are the “I want [fill in the blank] moments” where consumers are looking for information, entertainment, assistance, or something else. These moments matter to brands because this is when decisions are being made and preferences are being set—moments when brands need to deliver the right experience at the right time.

But which moments are the most impactful and how can brands identify and capitalize on those instances? With so many touchpoints in the customer lifecycle, it’s difficult to know what to focus on. This is why a data insights strategy is vital to measuring, understanding, and ultimately winning the moments that matter.

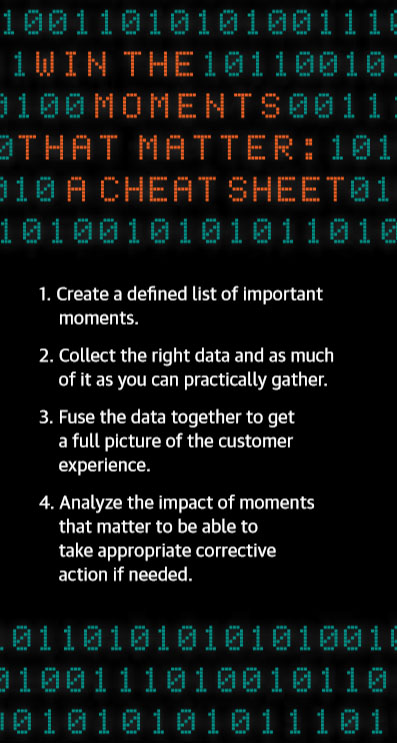

Win the Moments that Matter

Consider these two examples: Years ago a colleague of mine purchased a new sofa. Several months later, the store called her to ask if she was pleased with it. She was surprised and delighted with the follow up and told many friends about the experience, even though the purchase happened some time ago. She appreciated that the store still cared about her months after making the sale.

Meanwhile, another friend told me about the difficulty she had returning a product. She had a bad customer experience, one where her expectations were not met, and that experience colored her beliefs about the product and the brand that made it. She thought it should be easy to return the product but it wasn’t.

For brands to win moments that matter, they must make them personally relevant and exceed expectations. I once worked at a company where employees could praise their colleagues by filling out recognition cards with the person’s name and the reason that they deserved recognition. This is a common practice, but what was uncommon is that the head of the company would personally deliver the recognition cards and thank employees for their hard work. To this day, I recall the thrill of watching the CEO walk around the floor and stop at people’s desks. This act of thanks engendered a lot of employee goodwill and staff retention.

So how do businesses measure how much benefit is gained from having the CEO personally thank employees, or from other moments that matter? It is a four-step process, and much of it centers around data. First, focus on a defined list of moments that matter. Second, collect the right data and as much of it as you can practically gather. Third, fuse the data together to get a full picture of the customer experience. Finally, analyze the impact of moments that matter to take appropriate corrective action if needed.

Define the Moments to Measure

There are many potential moments that matter across the customer lifecycle, and it is easy to become overwhelmed. For companies with a customer journey map, this is the ideal place to start. Select moments to measure based on their importance and your ability to capture data around them.

If you do not have a customer journey map, consider grouping your customers into these six stages, described by KPMG Nunwood, and determine which are the most important to measure first:

- Wooing: This early stage is when the foundation of a relationship is laid.

- Purchase: A key moment that matters, this is when promises are made and expectations are set.

- Honeymoon: At this point, right after the purchase, the customer and business alike are looking to reinforce the decisions they made to be in this relationship.

- Forming: This is when the customer and company are figuring out the best way to work together.

- Storming: Once the honeymoon ends, reality takes hold. Problems can arise and need to be resolved quickly to maintain the relationship.

- Norming: In this stage, standards are set and agreements are made outlining how the relationship between brand and consumer will work.

Collect and Fuse the Right Data

To accurately measure moments that matter, companies need a range of data about their customers to develop a comprehensive understanding of who they are, what they have purchased, how they interact and engage with the company, and their attitudes toward the brand. Data should be as diverse as possible—but be wary that large gaps in data will provide, at best, an incomplete picture and, at worst, a misleading one.

When researching and evaluating data to include, consider:

- Demographics (or firmographic data for B2B companies).

- Purchase history (both online and in-store).

- Loyalty program data.

- Omnichannel engagement, such as app usage, browsing behavior, email engagement, and social interactions.

- Customer feedback, including structured feedback like surveys, as well as unstructured feedback like calls to the contact center or social media posts.

- Customers’ emotions and attitudes about the brand.

To get value from this data, companies need to fuse the various data sources. It is particularly important to integrate customers’ online and offline activity. Much of consumers’ product research and shopping happens online.In addition, they engage with a brand and provide valuable feedback digitally. Remember, people are omnichannel, so data needs to be omnichannel too. Some online data may be difficult to integrate, but identity matching can help link some online and offline behaviors.

Analyze the Impact

Next, brands need to identify the outcome metric or success metric they want to measure, such as revenue or additional products purchased. But for some industries, it could be unlikely that a customer will make another purchase if the customer is early in the lifecycle. In that case, keeping the customer engaged until they are ready to buy again can be an outcome measure.

Once an outcome metric is established, measure how interactions impact the desired behavior. For example, measure the additional revenue or return visits generated with a positive experience versus a negative one during a moment that matters. The difference is the impact of a positive experience over a negative one. It may be that a single, poor experience causes some consumers to switch to a competitor, but it is not necessarily so. There are other mitigating factors such as convenience, habit, or loyalty that will keep customers returning despite a bad experience.

For example, we have found that loyal customers are likely to return to a brand, despite having a bad experience. Unlike new customers, they view a bad experience within the context of all the other experiences they have had with a brand and recognize that bad experience as an aberration rather than the norm. New customers don’t have that history to draw upon. Regardless, it is important to resolve a bad customer experience quickly, as customers will be more willing to come back if their problem was resolved satisfactorily.

Knowing the impact of a good experience over bad, brands can wisely allocate dollars and work on resolving poor experiences during the moments that matter. Plus, armed with detailed data about both the consumer and their experience, companies can provide a remedy that is tailored to the situation and the individual. In some cases, a heartfelt sorry is enough and in others, goodwill in the form of a coupon or discount is required.

One caveat: Those remedies need to be personally relevant but not creepy. Consumers provide data with the expectation that it will be used wisely and not intrusively. Providing a remedy that makes the consumer feel unsettled or uncomfortable defeats the purpose. Companies have to walk a fine line—offering a personalized experience without crossing over to invasiveness. Plus, data might be wrong; a colleague of mine recently checked her profile that a third-party data aggregator had compiled and found some glaring errors. The resolution of a bad experience should leave the consumer feeling satisfied and restore their positive view of the company.